NEWS

Global Population Reaches Record High

By ANGELA SMITH - Sunday, March 9, 2251

The results of the most recent Vieneo census were completed today and with a new count of 108730 colonists is a new all-time record high!

Approach Results in Disaster

By ANGELA SMITH - Saturday, March 8, 2251

PHOTOGRAPHER; BILL KENDALL

An E-11 Saint, operated by Mineral Mountain Madness Co., erupted in flames after crashing into Freedom Mine 01 in the Ihoh region during a failed landing attempt yesterday at 19:52Z. The pilot was the only one aboard and was pronounced dead at the scene.

Refined Fuel Commodity Boom

By JAMES THILL - Friday, March 7, 2251

Refined Fuel commodity prices are enjoying their best run in almost six years at 189 CR/MT as of Saturday, fresh evidence that investors are betting on a pickup in the global economy after years of sluggish growth and scant inflation. Now, as signs of inflation and improving global demand have returned, investors are beginning to pile back into commodities. A sustained rally in commodities would likely signal healthy consumer and business demand.

Unemployment Rampant

By JAMES THILL - Monday, March 3, 2251

The USR authorities report on Tuesday that Deois unemployment has risen to the highest level in about a month. That is a reported 0.40% of Deois inhabitants not officially employed. Who are these people? Where are they hiding? How do they survive? Of course, many will be the wives and families of hard-working colonists. And some will be casual laborers looking for work. But maybe there is a dark underbelly to our world? What are the implications for crime and of course for personal protection? We will follow this story.

If you have an idea for a story, error to report, stock photograph to submit, or would like to advertise in this publication, please contact news@risetvp.com.

LATEST HEADLINESSunday, March 9, 2251

Consumer Goods Commodity Slump

By ANGELA SMITH - Sunday, March 9, 2251

Consumer Goods commodity prices are at their lowest price in over three years at 6386 CR/MT as of today, fresh evidence that investors are betting on a downturn in the global economy after years of sluggish growth and scant inflation. Now, as signs of inflation and improving global demand have returned, investors are beginning to shy away from commodities. A sustained slump in commodities would likely signal unhealthy consumer and business demand.

Fabricated Materials Commodity Boom

By ANGELA SMITH - Sunday, March 9, 2251

Fabricated Materials commodity prices are enjoying their best run in about a month at 190 CR/MT as of today, fresh evidence that investors are betting on a pickup in the global economy after years of sluggish growth and scant inflation. Now, as signs of inflation and improving global demand have returned, investors are beginning to pile back into commodities. A sustained rally in commodities would likely signal healthy consumer and business demand.

Unrefined Fuel Ore Commodity Slump

By ANGELA SMITH - Saturday, March 8, 2251

Unrefined Fuel Ore commodity prices are at their lowest price in about a year at 61 CR/MT as of yesterday, fresh evidence that investors are betting on a downturn in the global economy after years of sluggish growth and scant inflation. Now, as signs of inflation and improving global demand have returned, investors are beginning to shy away from commodities. A sustained slump in commodities would likely signal unhealthy consumer and business demand.

Investigators Pick Up the Pieces

By ANGELA SMITH - Thursday, March 6, 2251

An E-11 Saint, operated by Mineral Mountain Madness Co., came apart in mid-air over an empty field in the Trebmal region Friday at 23:07Z. Witnesses report the tail section detaching from the fuselage. All 127 aboard were killed (including 1 crew member). After recovering the "black box" the team investigating found the E-11 was at an altitude of 26 km.

DeoisPort Eating Food Reserves

By JAMES THILL - Thursday, March 6, 2251

The 31999 colonists at Deois Port District are down to 14 days of food remaining!

Colonies Give a “Thumbs Up” for Vieneo

By JAMES THILL - Tuesday, March 4, 2251

Total Colonies has reached a new high of 264 establishments on Wednesday. This is fresh evidence that Vieneo is an increasingly attractive destination for investors willing to bet their fortunes on an improving economy. Welcome news after years of indifferent growth in GDP. The increase in colonies reflects the increased demand for commodities. This sustained rally in commodities also benefits a thriving economy generally, with increased consumer and business activity. Of course, any economy is a dynamic entity, and pockets of inflation are to be expected as the global economy adjusts to the new circumstances. These are welcome signs of a healthy, vigorous and better world.

Police Investigate Fatal Crash

By ANGELA SMITH - Saturday, March 1, 2251

A C-2A Dasher, driven by Midshipman JADE VINZANT (gothicer), crashed off-roading in Deois Financial District earlier this month. Both the driver and their passenger were killed instantly.

Consumer Goods Commodity Slump

By ANGELA SMITH - Sunday, March 9, 2251

Consumer Goods commodity prices are at their lowest price in over three years at 6386 CR/MT as of today, fresh evidence that investors are betting on a downturn in the global economy after years of sluggish growth and scant inflation. Now, as signs of inflation and improving global demand have returned, investors are beginning to shy away from commodities. A sustained slump in commodities would likely signal unhealthy consumer and business demand.

Fabricated Materials Commodity Boom

By ANGELA SMITH - Sunday, March 9, 2251

Fabricated Materials commodity prices are enjoying their best run in about a month at 190 CR/MT as of today, fresh evidence that investors are betting on a pickup in the global economy after years of sluggish growth and scant inflation. Now, as signs of inflation and improving global demand have returned, investors are beginning to pile back into commodities. A sustained rally in commodities would likely signal healthy consumer and business demand.

Unrefined Fuel Ore Commodity Slump

By ANGELA SMITH - Saturday, March 8, 2251

Unrefined Fuel Ore commodity prices are at their lowest price in about a year at 61 CR/MT as of yesterday, fresh evidence that investors are betting on a downturn in the global economy after years of sluggish growth and scant inflation. Now, as signs of inflation and improving global demand have returned, investors are beginning to shy away from commodities. A sustained slump in commodities would likely signal unhealthy consumer and business demand.

Investigators Pick Up the Pieces

By ANGELA SMITH - Thursday, March 6, 2251

An E-11 Saint, operated by Mineral Mountain Madness Co., came apart in mid-air over an empty field in the Trebmal region Friday at 23:07Z. Witnesses report the tail section detaching from the fuselage. All 127 aboard were killed (including 1 crew member). After recovering the "black box" the team investigating found the E-11 was at an altitude of 26 km.

DeoisPort Eating Food Reserves

By JAMES THILL - Thursday, March 6, 2251

The 31999 colonists at Deois Port District are down to 14 days of food remaining!

Colonies Give a “Thumbs Up” for Vieneo

By JAMES THILL - Tuesday, March 4, 2251

Total Colonies has reached a new high of 264 establishments on Wednesday. This is fresh evidence that Vieneo is an increasingly attractive destination for investors willing to bet their fortunes on an improving economy. Welcome news after years of indifferent growth in GDP. The increase in colonies reflects the increased demand for commodities. This sustained rally in commodities also benefits a thriving economy generally, with increased consumer and business activity. Of course, any economy is a dynamic entity, and pockets of inflation are to be expected as the global economy adjusts to the new circumstances. These are welcome signs of a healthy, vigorous and better world.

Police Investigate Fatal Crash

By ANGELA SMITH - Saturday, March 1, 2251

A C-2A Dasher, driven by Midshipman JADE VINZANT (gothicer), crashed off-roading in Deois Financial District earlier this month. Both the driver and their passenger were killed instantly.

BUSINESS

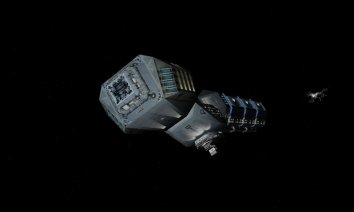

FTL Visiting Easydock (TAC)

By MARY STULL - Sunday, March 9, 2251

PHOTOGRAPHER; IAN LAMBERT

The DIHV ship Terania (IVR 3317-A) arrived today at 05:28Z.

ADVERTISEMENT

Private Price Control

By LUCINDA SMITH - Thursday, March 6, 2251

PHOTOGRAPHER; SHAUN A. STAGG

The commodities at SHARNEYDUBS OUTLET STORE are once again managed internally.

Ground Breaking Ceremony

By MARY STULL - Sunday, March 2, 2251

Mineral Mountain Madness Co. began construction on a new farming colony at 3M Comstock last Monday. Nearby colonists are excited at the new opportunities it brings to the Ittaniccin region.

Ground Breaking Ceremony

By LUCINDA SMITH - Saturday, March 1, 2251

Mineral Mountain Madness Co. began construction on a new farming colony at 3M Comstock earlier this month. Nearby colonists are excited at the new opportunities it brings to the Ittaniccin region.

Ground Breaking Ceremony

By LUCINDA SMITH - Saturday, March 1, 2251

Mineral Mountain Madness Co. began construction on a new farming colony at Freedom earlier this month. Nearby colonists are excited at the new opportunities it brings to the Ihoh region.